Some Known Factual Statements About Paul B Insurance

Wiki Article

Paul B Insurance - Questions

Table of ContentsNot known Facts About Paul B InsuranceThe Ultimate Guide To Paul B InsuranceGet This Report about Paul B InsuranceThings about Paul B InsurancePaul B Insurance Fundamentals ExplainedExcitement About Paul B Insurance

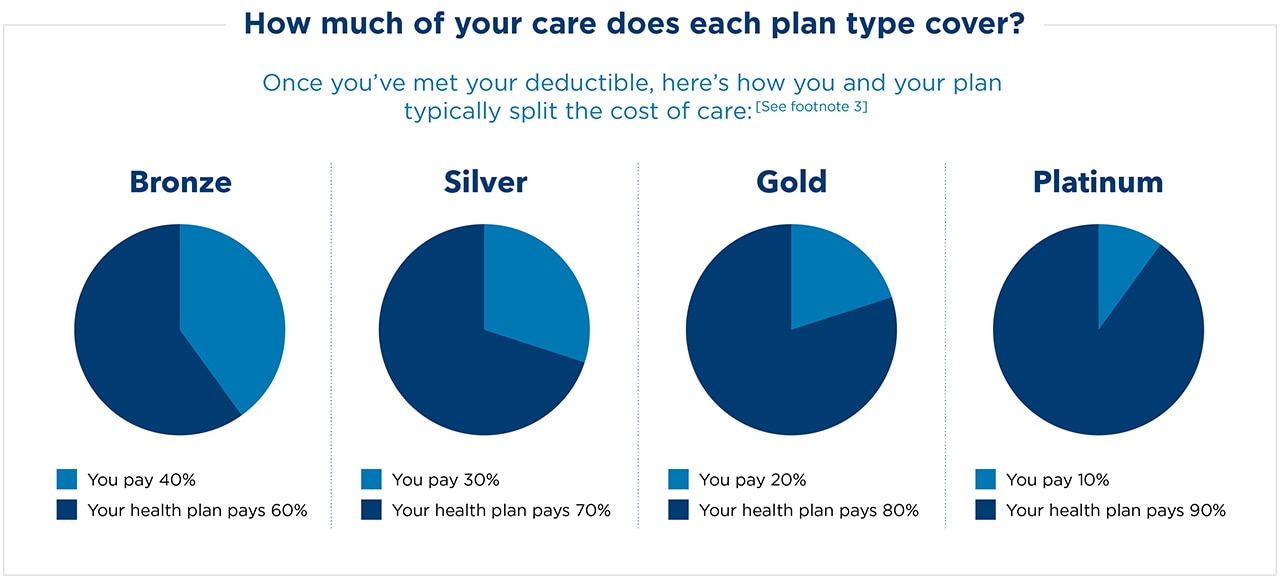

Coinsurance: This is the portion (such as 20%) of a medical charge that you pay; the remainder is covered by your medical insurance strategy. Deductible: This is the amount you spend for protected healthcare prior to your insurance coverage starts paying. Out-of-pocket optimum: This is the most you'll pay in one year, out of your own pocket, for protected wellness care.

Out-of-pocket costs: These are all prices above a plan's costs that you need to pay, including copays, coinsurance and deductibles. Costs: This is the regular monthly amount you spend for your health and wellness insurance strategy. In general, the greater your costs, the lower your out-of-pocket prices such as copays and coinsurance (and also the other way around).

By this step, you'll likely have your alternatives limited to just a couple of plans. Below are some points to consider following: Check the extent of services, Go back to that recap of advantages to see if any of the strategies cover a broader scope of solutions. Some may have far better protection for points like physical therapy, fertility therapies or psychological healthcare, while others could have much better emergency situation coverage.

Top Guidelines Of Paul B Insurance

Sometimes, calling the plans' client solution line might be the very best way to get your concerns addressed. Write your concerns down beforehand, and also have a pen or digital device useful to tape the solutions. Here are some examples of what you could ask: I take a certain drug.Ensure any type of plan you select will certainly spend for your normal and needed treatment, like prescriptions and also professionals.

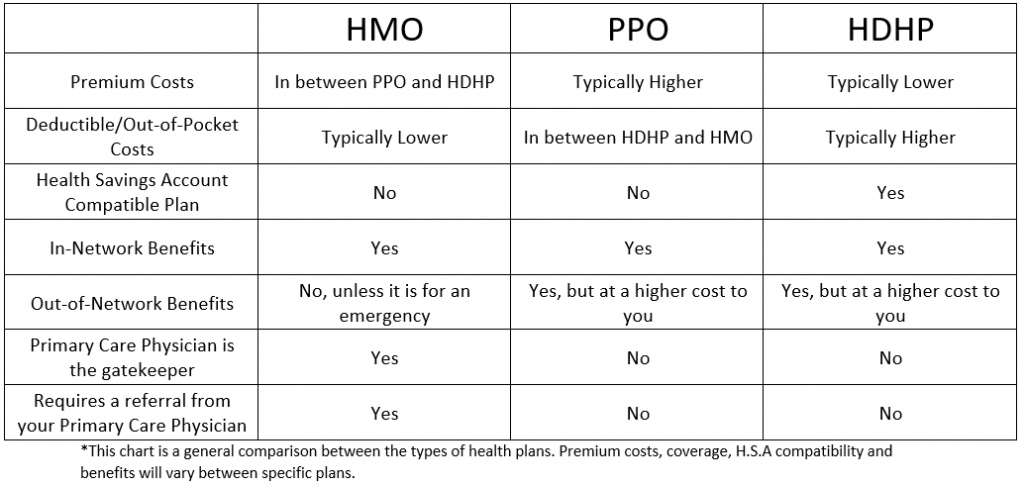

As you're searching for the appropriate health insurance, a good step is to determine which prepare type you need. Each plan type balances your costs and risks differently. Think of your wellness treatment usage as well as budget plan to discover the one that fits.

Wellness insurance coverage (likewise called health and wellness insurance coverage or a health and wellness plan) assists you pay for clinical treatment. All health insurance strategies are different.

Not known Facts About Paul B Insurance

You can discover strategy summaries as well as obtain information regarding wellness plans for you as well as your youngsters in your state's Health and wellness Insurance policy Marketplace. This is an on the internet source set up by the Affordable Care Act that assists you locate and contrast wellness strategies in your state. Each plan in the Market has a recap that includes what's covered for you and also your family.When contrasting wellness insurance plans, take a look at these costs to aid you choose if the plan is best for you: This is the amount of money you pay monthly for insurance coverage. This is the quantity of cash you need to spend before the plan begins spending for your healthcare.

This is the quantity of money you pay for each health care solution, like a see to a health and wellness care provider. This is the highest possible quantity of money you would have to pay each year for see here now wellness treatment services.

Here's what to look for in a health insurance when you're thinking of companies: These providers have an agreement (agreement) with a health insurance to give medical solutions to you at a discount rate. In several situations, mosting likely to a favored carrier is the least costly means to get wellness care.

All About Paul B Insurance

This implies a health and wellness strategy has various costs for different companies. You might need to pay even more to see some carriers than others. If you or a relative already has a healthcare service provider and you wish to maintain seeing them, you can discover which intends consist of that provider.

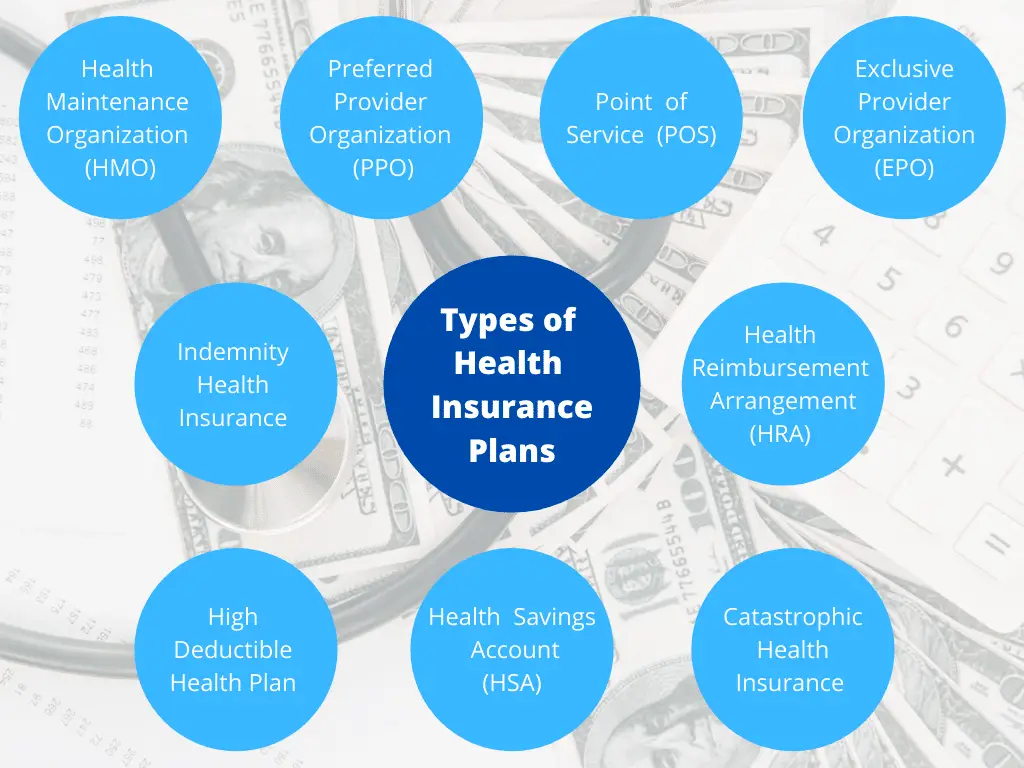

When contrasting medical insurance plans, comprehending the distinctions between medical insurance types can assist you pick a plan that's finest for you. Medical insurance is not one-size-fits-all, and the variety of alternatives reflects that. There are a number of kinds of wellness insurance prepares to select from, and also each has actually associated expenses as well as constraints on service providers as well as brows through.

To prosper of the game, check your current healthcare plan to address examine your insurance coverage and understand your plan. And, take a look at for more particular health care plan information. To discover exactly how State Farm may be able to help with your health insurance requires, speak to your representative today.

The Best Strategy To Use For Paul B Insurance

my website

If it's an indemnity strategy, what kind? Is that HMO typical, or open-access? With many plan names so vague, how can we figure out their type? Since the Bureau of Labor Statistics (BLS) began reporting on medical plans over 30 years ago, it has identified them by type. Naturally, plans have actually transformed fairly a little bit in thirty years.

A strategy that acquires with medical companies, such as healthcare facilities as well as physicians, to create a network. Patients pay much less if they utilize companies who come from the network, or they can make use of companies outside the network for a higher price. A plan comprising teams of healthcare facilities as well as doctors that agreement to offer extensive clinical services.

Such strategies commonly have differing coverage degrees, based on where solution takes place. The plan pays extra for service executed by a restricted collection of companies, much less for services in a wide network of service providers, and also even less for solutions outside the network. A plan that supplies pre-paid comprehensive healthcare.

Paul B Insurance Things To Know Before You Buy

In Exhibit 2, side-by-side comparisons of the 6 kinds of medical care plans show the differences figured out by solution to the 4 inquiries about the plans' functions. As an example, point-of-service is the only strategy type that has greater than two levels of benefits, as well as fee-for-service is the only kind that does not utilize a network.The NCS has actually not added plan kinds to account for these however has identified them right into existing plan kinds. In 2013, 30 percent of medical plan individuals in personal industry were in strategies with high deductibles, as well as of those employees, 42 percent had accessibility to a health financial savings account.

Report this wiki page